Navigating the Market’s Crosscurrents

What the Conflicting Signals Mean for Investors

Quick Take

Stocks powered to record highs in Q3 on strong corporate earnings and AI enthusiasm, even as job growth slowed and economic data sent conflicting messages.

Valuations are running hot, opportunities outside the hottest segments are still present. The S&P 500’s surge has pushed valuations toward historic levels, but small-cap, and international markets continue to offer attractive entry points for long-term investors.

With the labor market cooling, the Federal Reserve’s recent rate cut signals a shift toward supportive policy — a potential tailwind for both stocks and bonds heading into year-end. Political pressure complicates the messaging for the Fed.

Staying Focused Amid the Market’s Crosscurrents

Market swings are an unavoidable part of investing — and this year has reminded us of that in full color. From tariff-related sell-offs to powerful rebounds, the ride has been anything but smooth. Yet these fluctuations are what make long-term investing work. Declines can open the door to better opportunities, while recoveries reward patience and discipline.

As we move into the final quarter of the year, investors are navigating a mixed backdrop. The S&P 500 hit new record highs in the third quarter, powered by resilient corporate earnings and ongoing enthusiasm for artificial intelligence. At the same time, job growth has slowed noticeably since early summer, leading to questions about the health of consumers and the broader economy. Still, GDP growth remains solid, and inflation appears to be under control.

Periods like these — when markets send conflicting signals — are precisely when preparation, careful planning, and long-term perspective prove their worth. Rather than reacting to each new headline, successful investors stay focused on their broader goals and ensure their portfolios are designed to weather both calm and stormy conditions.

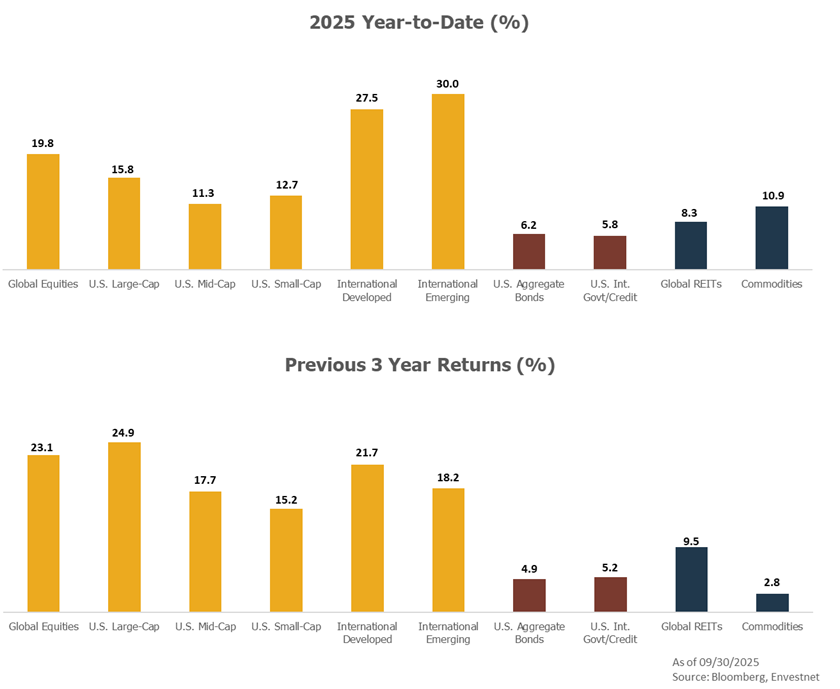

A Strong Quarter for Markets

The third quarter was a powerful reminder of how quickly sentiment can shift. Global stocks continued their upward march, with the All-Country World Index returning 7.6%. The S&P 500 gained 8.1%, and the tech-heavy Nasdaq climbed 11.4%. All three reached record highs in September, capping an impressive year-to-date performance of 19.8%, 15.8%, and 19.4% respectively.

Precious metals and cryptocurrencies gained as concerns over public sector budget deficits grew. Gold climbed to a record $3,841 per ounce — a 16% gain — and Bitcoin recovered to $114,641, though still below its summer high. The U.S. dollar continued to weaken, falling nearly 10% year-to-date, which has provided a tailwind for international assets.

Bonds also participated in the rally. The Bloomberg U.S. Aggregate Bond Index rose 2.0% in the quarter and is now up 6.1% for the year. The 10-year Treasury yield ended the quarter at 4.15%, down from earlier peaks, as investors grew more confident that inflation is cooling.

The tax-exempt municipal bond market rallied in September after lagging taxable bonds for much of the year. Worries over tax reform and a glut of issuance from state and local governments had weighed on the market.

Inflation, while still above the Fed’s long-term target, has moderated, with consumer prices up 2.9% in August. Job creation, however, has slowed considerably, with only 22,000 new positions added in August. In response, the Federal Reserve trimmed interest rates by 0.25% in September — its first cut this year.

Valuations Are High, but Opportunities Remain

After such a strong rebound, it’s no surprise that valuations have climbed. The Shiller price-to-earnings ratio for the S&P 500 now sits at 38x, well above its long-term average. This reflects both optimism and the strength of the recent rally — the S&P 500 has risen 34% since April.

Technology continues to lead the charge, with the so-called “Magnificent 7” stocks up more than 60% from their lows. While questions remain about how much artificial intelligence will boost corporate profits, it’s clear that innovation remains a powerful engine for both markets and the broader economy.

It’s worth noting that valuations are not extreme across the board. Smaller companies, value-oriented sectors, and international markets look more attractively priced, creating potential opportunities for diversified investors with longer time horizons.

The Fed’s Next Move and What It Means

The Federal Reserve’s rate cut in September marked a shift toward easing after a long pause. The decision reflects a delicate balance: inflation is still above the Fed’s target, but the job market has softened. The Fed’s goal is to support continued growth without reigniting inflationary pressures.

While job creation has slowed and revisions show fewer jobs were added over the past year than initially thought, the overall labor market remains relatively healthy. Unemployment, at 4.3%, is still low by historical standards.

For investors, modest rate cuts can be positive. If the economy continues to expand, lower borrowing costs can support both corporate profits and consumer spending — key ingredients for sustained market growth.

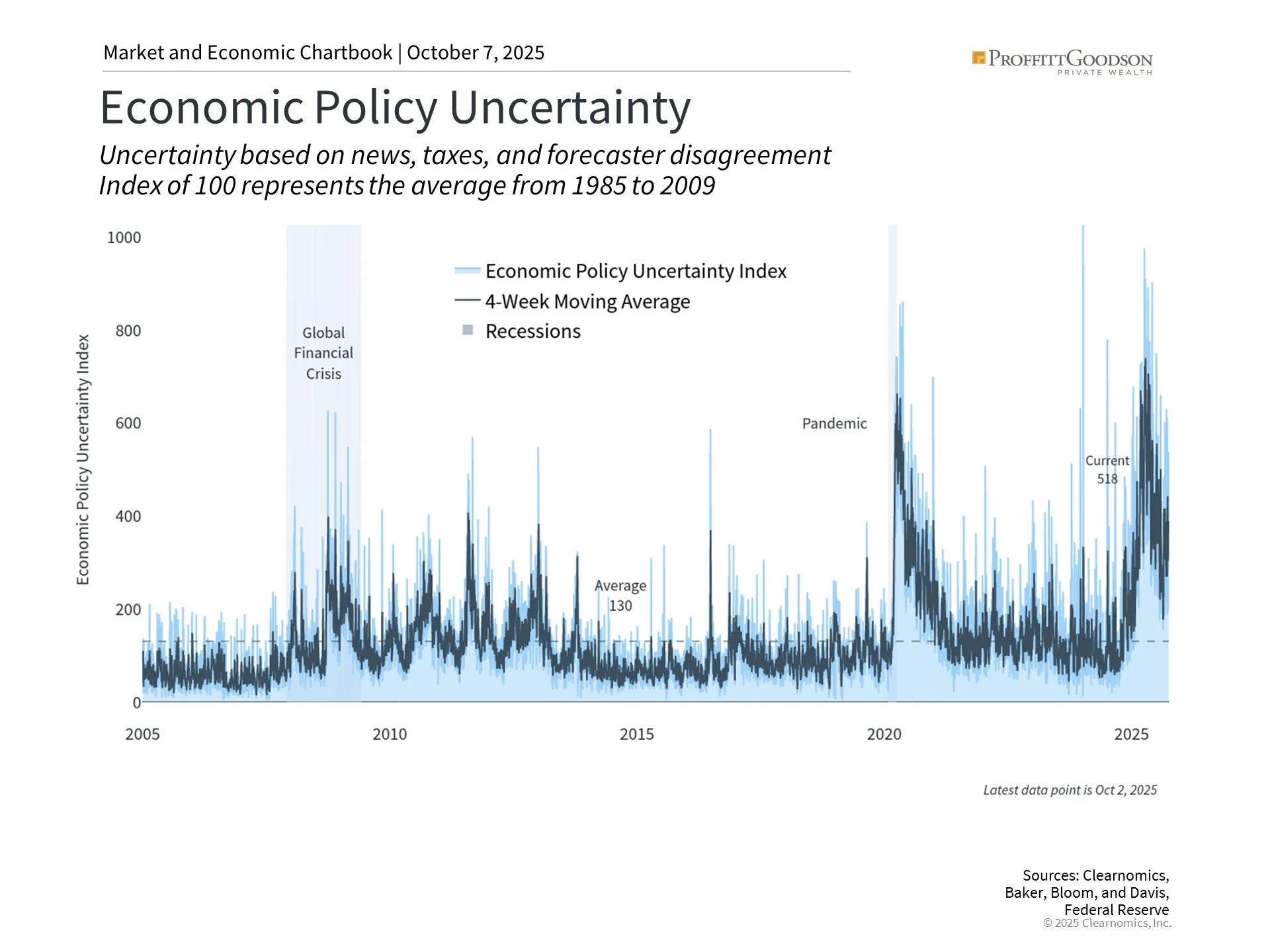

A Calmer Market — for Now

Volatility has eased in recent months. The VIX, a measure of stock market turbulence, is hovering below its long-term average, and bond market volatility has also declined. After several years of heightened uncertainty — from inflation shocks to geopolitical tensions — this relative calm is a welcome change.

That said, calm markets can quickly give way to new challenges. Trade tensions, policy debates in Washington, and global events could all spark renewed volatility. For long-term investors, though, uncertainty isn’t something to fear — it’s part of the landscape.

The key is to stay focused on what you can control: maintaining a disciplined investment approach, staying diversified, and ensuring your portfolio is aligned with your goals and time horizon. Markets will always move through cycles, but over time, patience and perspective remain the best tools for building lasting wealth.

Contact us at 865-584-1850 or info@proffittgoodson.com

DISCLOSURES: The information provided in this letter is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy, or investment product, and should not be construed as investment, legal, or tax advice. Proffitt & Goodson, Inc. makes no warranties with regard to the information or results obtained by third parties and its use and disclaims any liability arising out of, or reliance on the information. The information is subject to change and, although based on information that Proffitt & Goodson, Inc. considers reliable, it is not guaranteed as to accuracy or completeness. Source information is obtained from independent financial data suppliers (Interactive Data Corporation, Morningstar, etc.). The Market Categories illustrated in this Financial Market Summary are indexes of specific equity, fixed income, or other categories. An index reflects the underlying securities in a particular selection of securities picked due to a particular type of investment. These indexes account for the reinvestment of dividends and other income but do not account for any transaction, custody, tax, or management fees encountered in real life. To that extent, these index numbers are artificial and cannot be duplicated in real life due to the necessity of paying those transaction, custody, tax, and management fees. Industry and specific sector returns (technology, utilities, etc.) do not account for the reinvestment of dividends or other income. Future events will cause these historical rates of return to be different in the future with the potential for loss as well as profit. Specific indexes may change their definition of particular security types included over time. These indexes reflect investments for a limited period of time and do not reflect performance in different economic or market cycles and are not intended to reflect the actual outcomes of any client of Proffitt & Goodson, Inc. Past performance does not guarantee future results.