The Great Gold Debate: Store of Value or Speculative Spark?

Quick Take

Gold’s recent surge above $4,300 per ounce reflects investor concerns about currency “debasement,” fiscal deficits, and geopolitical uncertainty, though inflation and bond market indicators suggest such fears may be overstated.

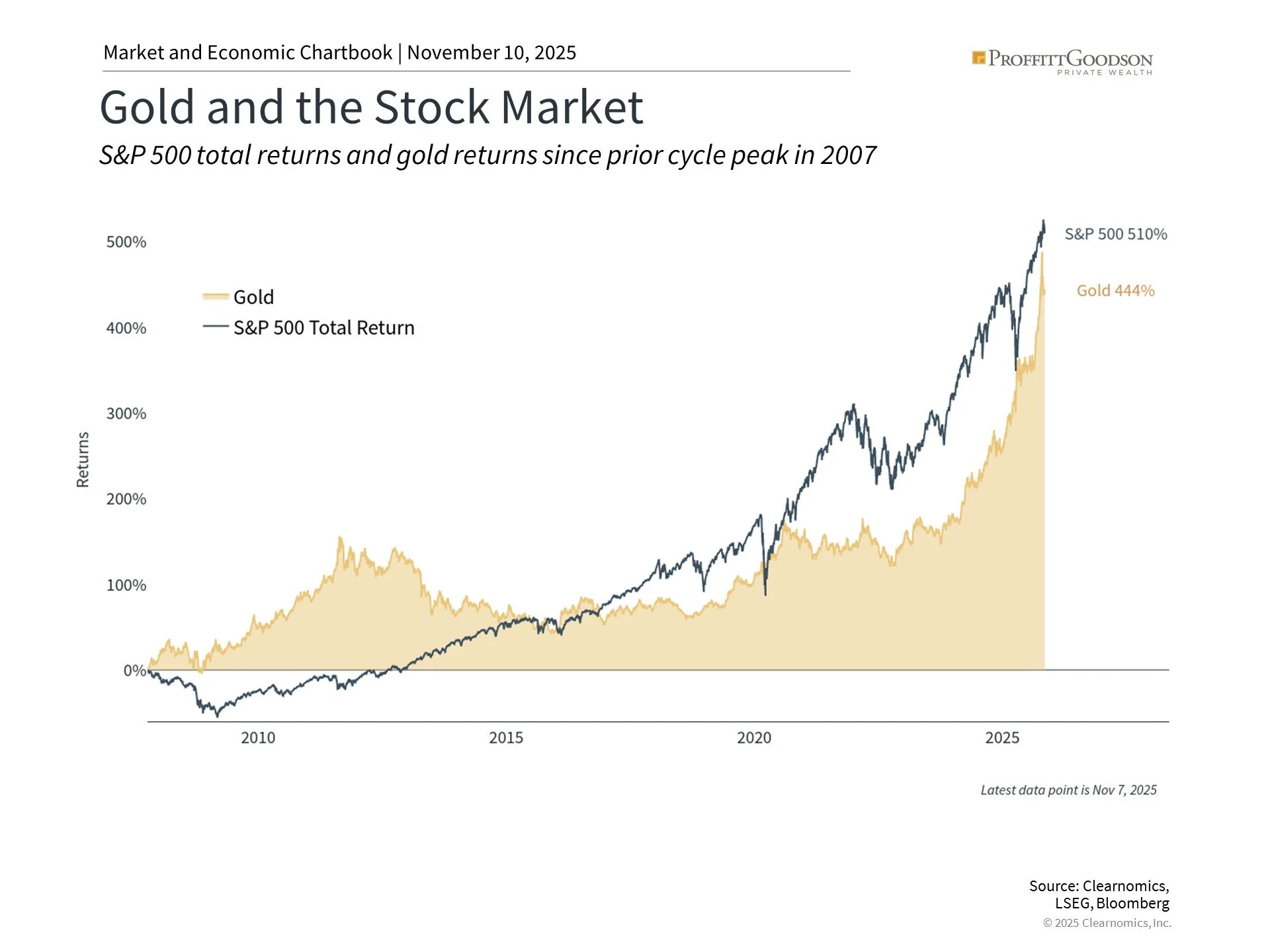

Historically, gold rallies—like those following the 1970s stagflation and the 2008 crisis—have proven difficult to sustain and often underperform equities over the long term.

While gold can serve as a portfolio diversifier, long-term investors are better served by maintaining balanced allocations across stocks and bonds rather than chasing short-term speculation.

As global markets climb to new highs, gold’s rally—surging more than 60% this year to above $4,300 per ounce—has caught the attention of investors worldwide. For many, it raises a familiar question: is this time different? While headlines focus on price records, discerning investors recognize that gold’s rise tells a deeper story about confidence, currency, and portfolio resilience.

The “Debasement Trade” and the Search for Stability

This year’s rally has been described as the “debasement trade,” reflecting concerns that governments are intentionally weakening their currencies through deficit spending and accommodative monetary policy. With a softer dollar and renewed volatility in equities, some investors have turned to gold—a traditional store of value—for stability.

Yet, it’s important to view this within a broader context. Inflation remains contained, with key measures such as the Consumer Price Index and the Personal Consumption Expenditures Index holding near 3% or less. Meanwhile, bond markets are signaling moderation rather than alarm: 10-year Treasury yields have retreated below 4%, and long-term inflation expectations implied by Treasury Inflation-Protected Securities sit around 2.3%.

In other words, while concerns about government debt and fiscal policy are valid, the data suggest a more nuanced environment than simple “debasement.”

A Brief History of Currency Debasement

Currency debasement is an old story, dating back thousands of years to when rulers diluted the precious metal content of coins. In modern economies, debasement takes the form of inflationary policies and prolonged low interest rates that can erode purchasing power over time.

Economists Carmen Reinhart and Kenneth Rogoff popularized the term financial repression to describe such periods—when policymakers maintain low real interest rates to ease the burden of government debt. For investors, this can feel like a quiet tax on cash and fixed income holdings.

However, despite ongoing debt concerns, the global economy today does not resemble the inflationary spirals of the 1970s. Inflation expectations remain anchored, and the U.S. dollar—though weaker this year—remains strong by historical standards.

Gold’s Long Record: Rewarding but Unpredictable

Gold has always inspired fascination, in part because its price movements are often extreme. In the late 1970s, it surged amid fears of stagflation, only to fall sharply after 1980. Following the 2008 financial crisis, it doubled from 2009 to 2011 on similar fears of runaway inflation and currency collapse—neither of which materialized.

Since then, gold has oscillated between periods of strong and weak performance, often diverging from expectations. Over longer horizons, equities—despite their volatility—have outperformed, rewarding investors who remained disciplined.

The takeaway for long-term investors is clear: gold can diversify a portfolio and provide protection during periods of stress, but it is not a substitute for a thoughtful allocation across asset classes.

Broad Gains Across Markets

This year’s strength in gold has coincided with remarkable gains across multiple markets, from AI-driven technology stocks to international equities, bonds, and even digital assets. The environment reflects broad liquidity and investor optimism rather than a singular flight to safety.

For some investors, gold plays a role within a broader allocation to commodities, which have also advanced. The Bloomberg Commodity Index, with a 15% weighting in gold, has risen over 12.5% year-to-date. Yet commodities as a whole remain cyclical and unpredictable, often providing diversification benefits but little long-term outperformance relative to stocks and bonds.

Balancing Short-Term Emotion with Long-Term Strategy

Periods of strong performance can tempt investors to chase momentum. But experienced investors understand that wealth is built not through reaction, but through balance. Gold has its place—as a hedge against uncertainty, a diversifier, and a store of value—but it should not dominate a portfolio.

With inflation-adjusted bond yields positive and corporate earnings growth supporting equities, a diversified mix of stocks, and bonds remains the most reliable approach to preserving and growing purchasing power.

Gold’s recent rise underscores the timeless importance of diversification, patience, and perspective. For investors, the goal is not to predict every market swing, but to design portfolios resilient enough to withstand them.

At its best, wealth management is about balance—between growth and preservation, opportunity and prudence. The gold rally serves as a reminder that while markets evolve, the principles of disciplined investing remain constant.

Contact us at 865-584-1850 or info@proffittgoodson.com

DISCLOSURES: The information provided in this letter is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy, or investment product, and should not be construed as investment, legal, or tax advice. Proffitt & Goodson, Inc. makes no warranties with regard to the information or results obtained by third parties and its use and disclaims any liability arising out of, or reliance on the information. The information is subject to change and, although based on information that Proffitt & Goodson, Inc. considers reliable, it is not guaranteed as to accuracy or completeness. Source information is obtained from independent financial data suppliers (Interactive Data Corporation, Morningstar, etc.). The Market Categories illustrated in this Financial Market Summary are indexes of specific equity, fixed income, or other categories. An index reflects the underlying securities in a particular selection of securities picked due to a particular type of investment. These indexes account for the reinvestment of dividends and other income but do not account for any transaction, custody, tax, or management fees encountered in real life. To that extent, these index numbers are artificial and cannot be duplicated in real life due to the necessity of paying those transaction, custody, tax, and management fees. Industry and specific sector returns (technology, utilities, etc.) do not account for the reinvestment of dividends or other income. Future events will cause these historical rates of return to be different in the future with the potential for loss as well as profit. Specific indexes may change their definition of particular security types included over time. These indexes reflect investments for a limited period of time and do not reflect performance in different economic or market cycles and are not intended to reflect the actual outcomes of any client of Proffitt & Goodson, Inc. Past performance does not guarantee future results.