Mercurial Market

Quick Take

November saw brief volatility driven by risk-off sentiment, AI-stock swings, shutdown-related data gaps, and shifting Fed cut expectations, but most asset classes stabilized by month-end.

Despite short-term pullbacks, 2025 has delivered strong YTD gains across stocks and bonds; the takeaway into year-end is to stay disciplined, diversified, and focused on long-term allocation rather than headlines.

November Market Recap and Year-End Perspective

November brought a brief bout of volatility across markets. Investors weighed concerns about AI-related stocks, the outlook for Fed rate cuts, and the impact of the government shutdown on economic data. By month-end, most asset classes stabilized, reinforcing an important message for long-term investors: short-term swings are normal, and disciplined portfolios are built to weather them.

Market Performance Snapshot

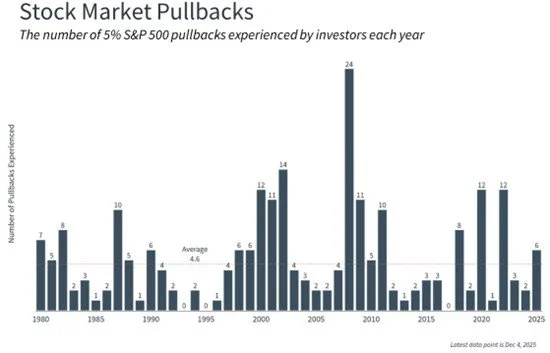

U.S. stocks: The S&P 500 settled up 0.1% in November after falling 5%, and is up 16% year-to-date. There have now been six declines of 5% or worse for the S&P 500 this year, the most since 2022 but close to the historical average.

International stocks: Developed markets rose modestly while emerging markets declined. Both have strong year-to-date returns, returning 24% and 27%, respectively.

Fixed income: Bonds advanced, with the Bloomberg U.S. Aggregate Bond Index up 1% in November and 8% YTD, helped by a decline in long-term yields. The 10-year Treasury ended near 4%.

Alternatives: Crypto saw a sharp pullback, underscoring its speculative nature. Bitcoin in particular has fallen over 30% from its early October highs. Gold finished higher but below October’s peak.

What Drove Markets in November

A temporary “risk-off” shift.

Investors stepped back from higher-risk areas such as technology stocks, high-yield credit bonds, and cryptocurrencies amid valuation and sustainability debates. Some of these areas rebounded late in the month as fundamentals reasserted themselves.

AI volatility, but resilient fundamentals.

AI-related stocks had their weakest stretch since spring, driven by concerns over spending, margins, and bubble risk. Still, earnings results from key companies such as Nvidia highlighted continued revenue and profit strength, supporting a late-month recovery in parts of the sector.

Shutdown-driven data uncertainty.

The longest government shutdown in history delayed critical economic reports. The September jobs report showed softer but still positive growth, and October data will be incomplete. Markets largely looked through the shutdown, but reduced visibility increased short-term uncertainty.

Shifting Fed expectations.

With fragmented data, rate-cut probabilities moved sharply during the month. Markets now expect a cut in December, with potential follow-ups in 2026 depending on growth and inflation trends.

Staying Grounded Into Year-End

Market pullbacks and reversals like November’s are a feature - not a flaw - of investing. The year has delivered strong gains across stocks and bonds, and short-term volatility doesn’t change the long-term case for maintaining diversified exposure aligned to your goals.

As we approach year-end, the key is to remain focused on your strategic allocation, risk management over headlines, and long-term planning over short-term positioning. We’ll continue monitoring markets and opportunities closely, and we’re here to discuss any portfolio or planning questions as we head into 2026.

Contact us at 865-584-1850 or info@proffittgoodson.com

DISCLOSURES: The information provided in this letter is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy, or investment product, and should not be construed as investment, legal, or tax advice. Proffitt & Goodson, Inc. makes no warranties with regard to the information or results obtained by third parties and its use and disclaims any liability arising out of, or reliance on the information. The information is subject to change and, although based on information that Proffitt & Goodson, Inc. considers reliable, it is not guaranteed as to accuracy or completeness. Source information is obtained from independent financial data suppliers (Interactive Data Corporation, Morningstar, etc.). The Market Categories illustrated in this Financial Market Summary are indexes of specific equity, fixed income, or other categories. An index reflects the underlying securities in a particular selection of securities picked due to a particular type of investment. These indexes account for the reinvestment of dividends and other income but do not account for any transaction, custody, tax, or management fees encountered in real life. To that extent, these index numbers are artificial and cannot be duplicated in real life due to the necessity of paying those transaction, custody, tax, and management fees. Industry and specific sector returns (technology, utilities, etc.) do not account for the reinvestment of dividends or other income. Future events will cause these historical rates of return to be different in the future with the potential for loss as well as profit. Specific indexes may change their definition of particular security types included over time. These indexes reflect investments for a limited period of time and do not reflect performance in different economic or market cycles and are not intended to reflect the actual outcomes of any client of Proffitt & Goodson, Inc. Past performance does not guarantee future results.