A Year to Appreciate

Quick Take

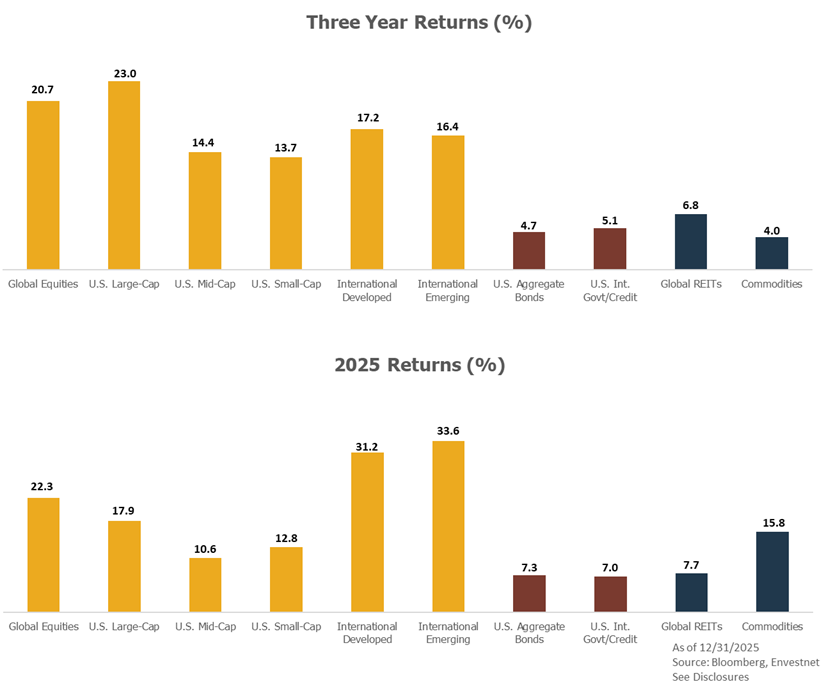

Markets proved remarkably resilient in 2025, delivery strong returns across U.S. and international equities, bonds, and real assets despite persistent policy, economic, and geopolitical uncertainty.

After an extended stretch of above-average performance, we believe the focus now should be on tempering expectations, maintaining diversification, and managing portfolio risk rather than chasing continued outsized gains.

While we do not anticipate an imminent downturn, disciplined rebalancing and thoughtful portfolio construction remain essential to staying prepared for inevitable market volatility.

It is hard not to be struck by how resilient markets proved to be in the face of constant uncertainty. The year delivered no shortage of headlines—April’s tariff announcements, ongoing developments in artificial intelligence, the passage of the One Big Beautiful Bill Act, and a steady drumbeat of geopolitical and economic surprises. Yet through it all, investors were rewarded with another exceptionally strong year.

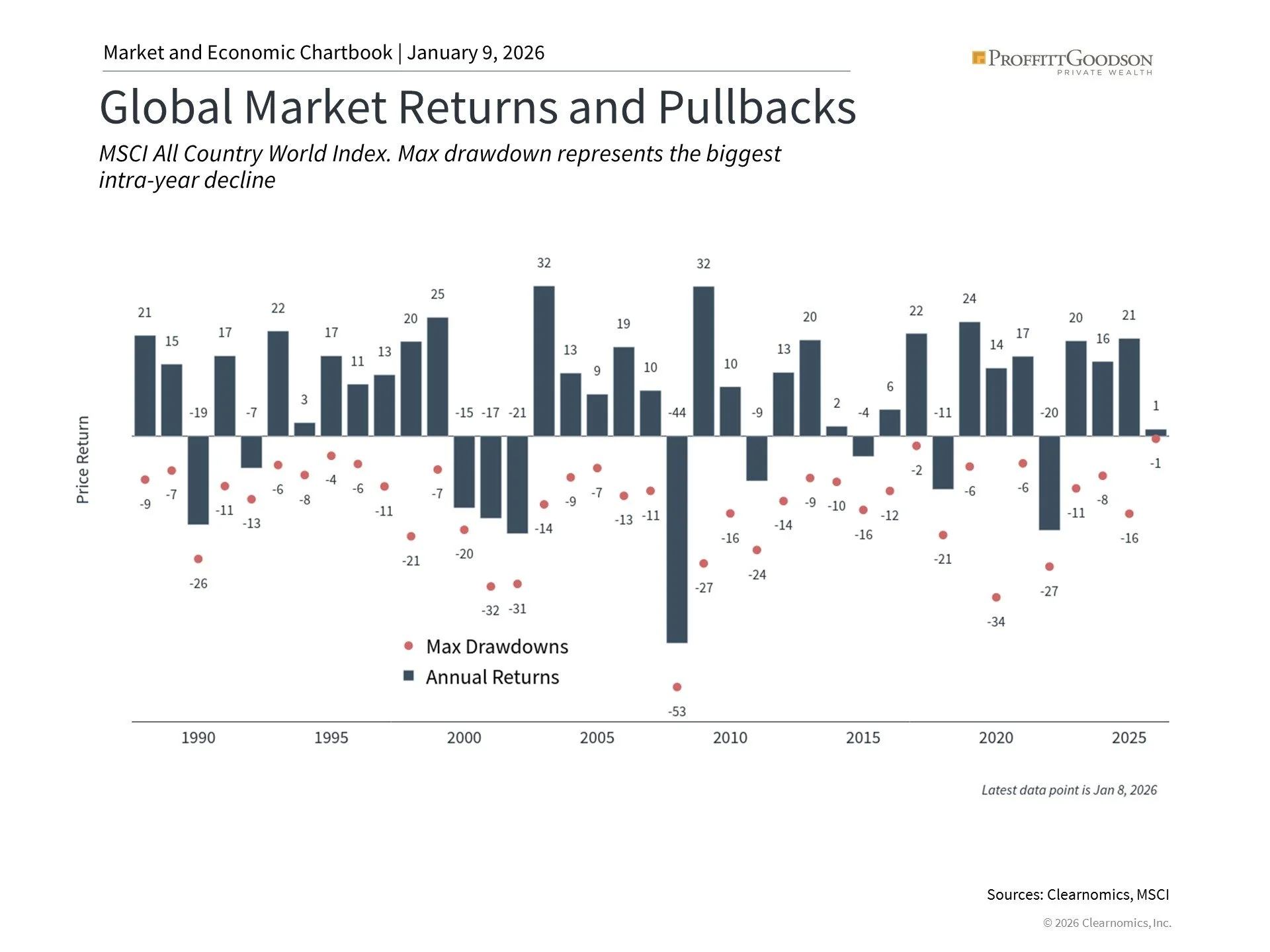

U.S. equities reached new record highs, international markets meaningfully outperformed, and bonds delivered their best returns in several years. The global equity market has now generated double-digit returns in six of the past seven years and has nearly doubled in value since the market bottom in 2022. These outcomes are welcome—but they also argue for perspective and prudence as we look ahead.

2025 Market Performance at a Glance

The S&P 500 gained 17.9% including dividends, achieving 39 new all-time highs. The Dow Jones Industrial Average rose 14.9%, while the Nasdaq Composite returned 21.2%.

Fixed income delivered a strong recovery year, with the Bloomberg U.S. Aggregate Bond Index gaining 7.3%, its best performance since 2020. The 10-year Treasury yield ended the year at 4.17%, down from 4.57% at the start of the year.

International markets led returns. Developed and emerging market equities each gained more than 30% in U.S. dollar terms, aided by a weaker dollar.

The U.S. dollar index declined 9.3% over the year, providing a meaningful tailwind for non-U.S. assets.

Gold rallied sharply, finishing the year up 64%, while silver more than doubled.

Digital assets were more volatile, with Bitcoin ending the year modestly lower after reaching a peak in October.

What Defined Markets in 2025

Three themes stood out over the past year.

First, artificial intelligence remained the dominant market narrative. Massive investment in AI infrastructure helped drive earnings growth and equity returns, particularly among the largest technology companies. Today, the so-called “Magnificent Seven” represent roughly one-third of the S&P 500—an unprecedented level of concentration. As a result, most investors have significant exposure to these companies, whether intentionally or not. Recognizing and managing this concentration risk will only grow more important over time.

Second, tariff policy and fiscal headlines created uncertainty but had less economic impact than many feared. Companies adapted, some policies were paused or scaled back, and consumer spending remained resilient. Once again, markets reminded us that policy changes—while important—do not always translate into immediate or obvious economic outcomes.

Third, returns broadened meaningfully across asset classes. International equities outperformed U.S. stocks, bonds recovered much of their 2022 losses, and real assets such as gold posted exceptional gains. This reinforced a timeless lesson: strong outcomes are less about selecting individual winners and more about maintaining a well-constructed, diversified asset allocation.

Looking Ahead: Tempering Expectations for 2026

Each year, Wall Street strategists offer confident forecasts for what lies ahead. History suggests these predictions are of limited value. Notably, entering this year, virtually no major strategist expects negative equity returns. While markets historically post gains more often than losses, periods of widespread optimism can coincide with more modest forward returns.

After an extended stretch of above-average performance, it is reasonable to anticipate more tempered returns—and occasional “white-knuckle” pullbacks—along the way. If the first weeks of this year are any indication, the geopolitical and economic news flow is unlikely to slow down. So be prepared for more surprises and often concerning headlines. This does not call for abandoning long-term plans, but rather for setting realistic expectations and ensuring portfolios are aligned with appropriate levels of risk and personal situations.

Our Approach and Current Opportunities

We build client portfolios to provide broad exposure to global markets while keeping costs low and managing taxes thoughtfully. Rather than trying to predict short-term market movements, we maintain steady exposure to the long-term risks that have historically rewarded investors over time.

Today’s market environment highlights the value of diversification—spreading investments across different regions, company sizes, and types of assets instead of relying on a single theme or outcome. With that in mind, here are several areas we believe offer attractive opportunities relative to others:

International Stocks - Stock prices outside the U.S. remain meaningfully lower than those in the U.S. A weaker U.S. dollar and improving corporate earnings—especially in emerging markets tied to technology and artificial intelligence—could support continued progress in these markets.

Small- and Mid-Sized Companies - While market performance has begun to broaden, smaller companies have trailed large U.S. firms recently. Over long periods, smaller companies have often delivered higher returns, particularly when borrowing conditions become more favorable.

Bonds - yields remain attractive when compared with expected inflation, improving the outlook for future returns. We are selective in corporate bonds, where investors are being paid less for taking additional risk. For clients in higher tax brackets, municipal bonds continue to offer especially appealing value.

Preparing for the Unexpected

While we do not anticipate an imminent downturn, preparation is essential. Strong equity markets naturally increase portfolio risk over time. For example, an investor with a 60/40 portfolio in 2019 who never rebalanced would today hold closer to 80% in equities—significantly increasing vulnerability to market declines.

We believe it is prudent to regularly reassess risk at both the asset-class level and within portfolios across sectors, regions, and individual holdings. Rebalancing is not a market-timing exercise; it is a risk-management discipline.

The economy will inevitably take unexpected turns. As we celebrate a strong year for investors, it is crucial to remain disciplined and grounded. Our guiding principle remains simple: expect more normal, prepare for something worse, and stay focused on long-term goals.

We will continue to rebalance, reassess, and position portfolios thoughtfully as conditions evolve—and we appreciate the trust you place in us.

Contact us at 865-584-1850 or info@proffittgoodson.com

DISCLOSURES: The information provided in this letter is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy, or investment product, and should not be construed as investment, legal, or tax advice. Proffitt & Goodson, Inc. makes no warranties with regard to the information or results obtained by third parties and its use and disclaims any liability arising out of, or reliance on the information. The information is subject to change and, although based on information that Proffitt & Goodson, Inc. considers reliable, it is not guaranteed as to accuracy or completeness. Source information is obtained from independent financial data suppliers (Interactive Data Corporation, Morningstar, etc.). The Market Categories illustrated in this Financial Market Summary are indexes of specific equity, fixed income, or other categories. An index reflects the underlying securities in a particular selection of securities picked due to a particular type of investment. These indexes account for the reinvestment of dividends and other income but do not account for any transaction, custody, tax, or management fees encountered in real life. To that extent, these index numbers are artificial and cannot be duplicated in real life due to the necessity of paying those transaction, custody, tax, and management fees. Industry and specific sector returns (technology, utilities, etc.) do not account for the reinvestment of dividends or other income. Future events will cause these historical rates of return to be different in the future with the potential for loss as well as profit. Specific indexes may change their definition of particular security types included over time. These indexes reflect investments for a limited period of time and do not reflect performance in different economic or market cycles and are not intended to reflect the actual outcomes of any client of Proffitt & Goodson, Inc. Past performance does not guarantee future results.